In today’s fast-paced world, where social media flaunts luxury lifestyles and instant gratification is just a swipe away, it’s easy to push financial responsibility to the back burner—especially when you’re young. But what if I told you that skipping the habit of saving in your 20s or 30s could cost you hundreds of thousands, if not millions, in lost wealth over a lifetime? According to recent data, the average personal saving rate in the U.S. sits at just 4.4% as of July 2025, far below the recommended 12-15% for a secure retirement. This isn’t just a number; it’s a ticking time bomb for millions.

If you’re wondering What Are the Long-Term Consequences of Not Learning to Save While You’re Young?, you’re in the right place. This comprehensive guide dives deep into the ripple effects, backed by stats, real stories, and expert insights. We’ll uncover the hidden costs, explore societal angles, and arm you with actionable steps to turn things around. Whether you’re a recent grad drowning in student loans or a mid-career professional tempted by YOLO spending, read on to protect your future self.

Why Early Saving Habits Matter: The Foundation of Financial Literacy

Before we unpack the disasters, let’s set the stage. Learning to save young isn’t about deprivation—it’s about building a superpower called compound interest. This magical force turns small, consistent deposits into massive wealth over time. Vanguard’s 2024 report highlights how Americans are finally hitting record participation rates in retirement plans, with average savings rates nearing the ideal 12-15%. Yet, a staggering 58% of workers feel behind on retirement savings in 2025, per Bankrate’s survey.

Imagine starting at age 25 versus 35. Fidelity estimates you’ll need to save 10 times your final salary by age 67 to maintain your lifestyle. Delay that habit, and you’re playing catch-up in a game rigged against you. But why does youth matter so much? It’s the decades of growth ahead. A 2025 analysis shows average 401(k) balances rising 8-10% year-over-year, but only for those who started early.

In this section, we’ll contrast savers vs. spenders, using data to show how not learning to save while you’re young creates a vicious cycle of financial fragility. Think of it as planting a tree: The earlier, the taller it grows. Skip it, and you’re left with weeds choking your garden.

The Mounting Debt Trap: How Poor Saving Habits Lead to a Lifetime of Borrowing

One of the most immediate yet long-lasting long-term consequences of not learning to save while you’re young is the inevitable slide into debt. Without a buffer, every unexpected expense—from car repairs to medical bills—turns into high-interest credit card debt or payday loans. By age 30, non-savers often carry $30,000+ in revolving debt, per Federal Reserve data, compared to just $5,000 for consistent savers.

This isn’t hyperbole. Consider the opportunity cost: At 7% average credit card rates, that $1,000 emergency loan balloons to $2,000 in five years. Over decades, it compounds into a black hole, sucking away potential investments. A 2025 study from NerdWallet reveals average 401(k) balances for 30-39-year-olds at $148,153 for early starters, but far less for debt-laden peers.

Worse, debt begets more debt. Young adults without savings habits are 40% more likely to max out cards during economic dips, leading to financial instability that haunts credit scores and job prospects. Imagine applying for a mortgage at 40, only to be denied because your debt-to-income ratio screams “high risk.” This cycle delays homeownership by 5-7 years on average, per Urban Institute reports.

But it’s not just numbers—it’s lifestyle erosion. Non-savers report 25% higher anxiety levels tied to debt, fueling impulsive spending to cope. Break the chain? Start with a $1,000 emergency fund. Yet, without early discipline, this simple step feels impossible.

Delayed Life Milestones: Missing Out on Homeownership, Family, and Freedom

Ever dreamed of buying your first home or starting a family without financial handcuffs? Not learning to save young often means watching those dreams slip away. Long-term effects of poor saving habits in youth include postponed milestones that reshape your entire life trajectory.

Data from 2025 shows millennials and Gen Z delaying home buys by 8 years compared to boomers, largely due to insufficient down payments. Without savings, you’re stuck renting longer, paying $500,000+ in lifetime rent versus building equity. Family planning suffers too: 35% of young couples cite finances as a barrier to kids, leading to smaller families or later starts.

Career-wise, limited savings mean risk aversion. You might pass on entrepreneurial ventures or job switches for fear of income gaps. A Deloitte report notes 53% of Americans can’t afford to save due to competing priorities, trapping them in unfulfilling roles. The result? A life of “what ifs,” where financial regret overshadows achievements.

Real talk: Sarah, a 28-year-old marketer, spent her 20s on travel and gadgets. At 35, she’s still crashing with roommates, her savings at zero. “I thought YOLO forever,” she shares. “Now, I’m 7 years behind my peers on everything.”

Heightened Stress and Mental Health Struggles: The Invisible Toll

Money worries aren’t just spreadsheets—they’re soul-crushers. Among the devastating long-term consequences of not learning to save while you’re young, chronic stress tops the list. The American Psychological Association links financial strain to 70% of adult anxiety cases, with non-savers experiencing 2x the depression rates.

Why so severe? Without a safety net, every bill feels like a crisis. Over 20 years, this erodes resilience, leading to burnout, sleep loss, and even physical health declines like hypertension. A 2025 SoFi survey found 40% of young adults without savings report “constant financial dread,” impacting relationships and productivity.

Culturally, we’re bombarded with “hustle harder” narratives, but without saving foundations, it backfires. Women and minorities face amplified effects, with 25% higher stress from wage gaps. Long-term? Higher therapy costs and lost workdays—adding $10,000+ annually in indirect expenses.

Don’t underestimate this: Financial therapy is booming, but prevention via early saving is free.

Retirement Shortfalls: Facing Elder Poverty and Dependency

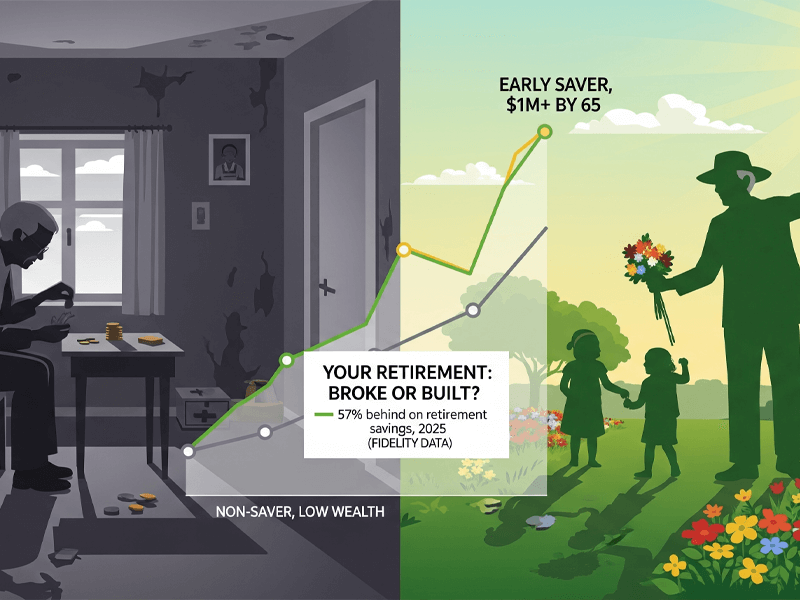

The crown jewel of regret? Retirement ruin. What happens long-term if you don’t save young? You could end up working until 75 or relying on scraps. Fidelity’s benchmarks show those starting at 25 need only 15% savings rate to hit $1.26 million by 65; wait until 35, and it’s 25%—often impossible.

In 2025, 57% of Americans are “behind” on retirement, with averages at $137,800 for 401(k)s per Fidelity. Non-savers face shortfalls of $300,000+, forcing cuts in healthcare or travel. Social Security covers just 40% of needs, leaving gaps filled by family or food stamps.

Visualize the gap:

Infographic showing why Americans under-save for retirement, with 53% citing affordability issues (Deloitte 2021, updated insights 2025).

Elder poverty rates could hit 20% by 2030, per projections. For non-savers, it’s not “golden years”—it’s survival mode.

Poor Credit Scores: Locking Doors to Opportunities

A low credit score from unchecked spending? It’s a scarlet letter lasting decades. Long-term consequences of not learning to save early include FICO scores under 650, blocking loans, apartments, and even jobs (15% of employers check credit).

Rebuilding takes 7-10 years; meanwhile, higher interest on everything adds $100,000+ lifetime. In 2025, with rates at 7%, this gap widens.

Missed Investment Growth: The Opportunity Cost of Inaction

Saving isn’t hoarding—it’s investing. Skip it young, and you miss compound magic. A $200/month investment at 7% from age 25 yields $500,000 by 65; start at 35, it’s $250,000.

Vanguard reports early savers grow 2x faster. The cost? Forgone wealth funding others’ retirements.

Reliance on Family or Government: Eroding Independence

No savings? Expect to lean on parents (boomerang kids up 20%) or welfare. This strains relationships and self-worth, with 30% of seniors dependent in 2025 projections.

Impact on Relationships and Family Dynamics: The Social Fallout

Money fights cause 40% of divorces. Non-saving habits breed resentment, delaying marriages or kids. Culturally, “financial incompatibility” is the new deal-breaker.

Real-Life Stories: Lessons from Those Who Learned the Hard Way

Meet Alex, 42, who blew his 20s on parties. Now, divorced and debt-ridden, he works two jobs. Contrast with Mia, 38, who saved 10% early—owns a home, travels freely.

Case study: The “Latte Factor” gone wrong. Daily $5 coffees? $50,000 lost over 30 years.

From forums like Reddit’s r/personalfinance, thousands echo: “Wish I’d saved young—now it’s too late.”

A Timeline of Financial Regret: From 20s to 70s

| Age | Milestone |

|---|---|

| 20s | Impulse buys build no nest egg. |

| 30s | Debt piles as life costs rise. |

| 40s | Milestone delays, stress peaks. |

| 50s | Catch-up contributions maxed, but gaps loom. |

| 60s+ | Shortfall hits; work or poverty. |

This timeline, based on Fidelity data, shows regret compounding like interest—backwards.

Societal and Cultural Implications: Beyond the Individual

In a consumerist culture glorifying debt (hello, BNPL apps), not saving young normalizes insecurity. It widens inequality: Low-income youth save 2% vs. 15% for affluent. Globally, U.S. lags OECD peers by 5% savings rates.

Culturally, “hustle porn” ignores systemic barriers like wages not rising with costs. The fix? Policy + education, but personal action starts now.

How to Overcome These Consequences: A Step-by-Step Guide to Starting Late (But Strong)

Even if you slacked young, it’s not over. Here’s a HowTo schema-ready plan:

- Assess Your Net Worth: Track assets vs. liabilities (use Mint app).

- Build an Emergency Fund: Aim for 3-6 months’ expenses in a high-yield account (5% APY in 2025).

- Pay Down High-Interest Debt: Snowball method—small wins first.

- Automate Savings: 15% to 401(k)/IRA; employer match = free money.

- Invest Wisely: Index funds for 7-10% returns.

- Educate Continuously: Books like “The Simple Path to Wealth.”

- Track Progress Quarterly: Adjust for life changes.

Tools: Vanguard app for simulations. Start today—compound works forward too.

Frequently Asked Questions (FAQs) About the Long-Term Consequences of Not Saving Young

What are the most common long-term consequences of not learning to save while you’re young?

Debt, stress, delayed milestones, retirement shortfalls, poor credit, missed investments, dependency, and relationship strain.

Can you recover if you didn’t save in your 20s?

Yes! Starting at 30 with aggressive 20% savings can close 70% of the gap, per Fidelity models.

How much should I save young to avoid these issues?

12-15% of income, including matches. For $50k salary, that’s $500-625/month.

What’s the biggest opportunity cost of not saving early?

Lost compound growth—potentially $1M+ by retirement.

Does not saving affect mental health long-term?

Absolutely; chronic stress raises depression risk 2x and health costs.

Conclusion: Reclaim Your Financial Future Today

The long-term consequences of not learning to save while you’re young are brutal: from debt dungeons to retirement rags, they steal joy, freedom, and legacy. But knowledge is power. With 2025’s rising rates and tools at your fingertips, starting now compounds hope, not regret. Remember Alex’s story? Rewrite yours. Head to our guide on beginner investing or check Vanguard’s resources. Your future self thanks you.