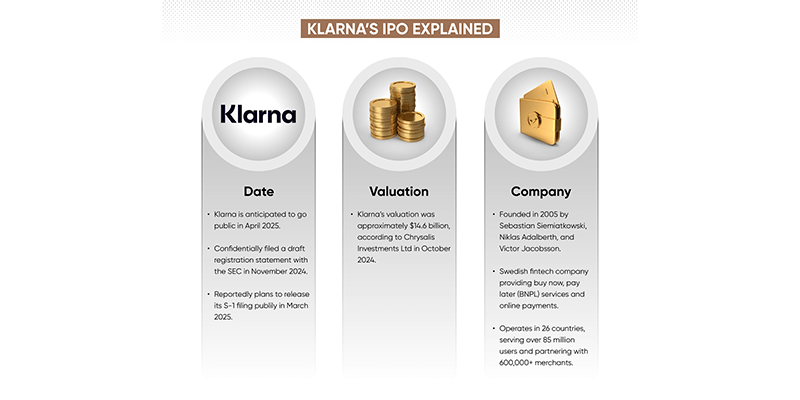

The Klarna IPO valuation is dominating fintech headlines as the Swedish “buy now, pay later” (BNPL) giant prepares for a 2025 public listing. Reports suggest Klarna is targeting a valuation as high as $14 billion, a striking comeback after its pandemic-era highs and lows. For investors and fintech watchers, this IPO isn’t just about one company—it’s a litmus test for the future of digital payments.

What Is Klarna and Why Does It Matter?

Founded in 2005, Klarna became a household name for its buy now, pay later service, letting shoppers split payments into installments with little or no interest. Over the years, it expanded into:

- E-commerce solutions for merchants.

- Klarna Card for flexible spending.

- AI-powered shopping app that blends payments, recommendations, and deals.

With over 150 million active users and merchant partnerships worldwide, Klarna has cemented its role in reshaping consumer finance.

The Rollercoaster Journey to IPO

Klarna’s path to IPO has been anything but smooth:

- 2021 peak: Valued at $46 billion during the BNPL boom.

- 2022 crash: Global fintech pullback slashed valuation to around $6–7 billion.

- 2023–2024 rebound: Profitability improved, losses narrowed, and Klarna leaned into AI-driven personalization.

Now, in 2025, Klarna is targeting up to $14 billion, signaling confidence that investors are ready to bet on fintech again.

7 Critical Insights on the Klarna IPO Valuation

1. BNPL Still Growing, But Scrutinized

Regulators in the UK, EU, and U.S. are tightening rules on BNPL providers. Klarna’s valuation depends on balancing growth with compliance.

2. Profitability Matters More Than Ever

Unlike past IPO hype cycles, investors want sustainable revenue. Klarna recently reported its first profitable year since 2018.

3. Competition Heats Up

Rivals like Affirm, Afterpay (Block), and Apple Pay Later are fighting for market share. Investors will weigh Klarna’s global scale vs. rising threats.

4. AI as a Growth Driver

Klarna has invested heavily in AI to improve fraud detection, credit scoring, and shopping personalization. Analysts believe this could boost margins long-term.

5. Investor Sentiment Shifts

The fintech sector is no longer chasing hypergrowth at any cost. A $14 billion valuation suggests tempered optimism, not bubble-era exuberance.

6. Strategic Partnerships Boost Confidence

Klarna’s deals with giants like Amazon and Shopify add weight to its IPO story, giving it credibility with both merchants and investors.

7. Geographic Expansion Is Key

Growth outside Europe and the U.S.—especially in emerging markets—may determine whether Klarna sustains its valuation post-IPO.

Market & Investor Impact

- Bullish case: Klarna redefines BNPL under strict regulation, uses AI to drive profits, and maintains global partnerships. IPO could spark renewed fintech investor confidence.

- Bearish case: Rising interest rates, tougher competition, and regulatory crackdowns erode margins, limiting long-term upside.

- Neutral view: IPO priced attractively, but upside capped by fintech sector maturity.

For investors, the Klarna IPO valuation represents both an opportunity and a risk—mirroring the entire BNPL sector’s uncertain trajectory.

FAQ: Klarna IPO Valuation

Q1: What is Klarna’s IPO valuation target?

As of 2025, Klarna is aiming for a valuation as high as $14 billion in its public listing.

Q2: Why did Klarna’s valuation fall from $46B to single digits?

The 2022 fintech downturn, rising interest rates, and investor caution led to a sharp decline.

Q3: Is Klarna profitable now?

Yes—after years of losses, Klarna reported profitability in 2024, strengthening its IPO case.

Q4: Who are Klarna’s biggest competitors?

Affirm, Afterpay (owned by Block), and Apple Pay Later are its main global rivals.

Q5: Why does Klarna’s IPO matter for investors?

It’s seen as a bellwether for fintech, showing whether public markets still believe in BNPL and digital payments firms.

Conclusion

The Klarna IPO valuation story is more than just a fintech headline—it’s a test of investor appetite for disruptive financial models in a post-hype era. By targeting a $14 billion valuation, Klarna signals confidence that it can thrive under regulation, competition, and evolving consumer expectations.

For investors, this IPO is a chance to weigh whether Klarna’s comeback is sustainable—or just another BNPL bubble in disguise.

Will you invest in the Klarna IPO, or do you see more risk than reward? Share your thoughts below and subscribe for fintech insights.